The next frontier of market abuse is here and it’s draining exchange insurance funds, right under your nose.

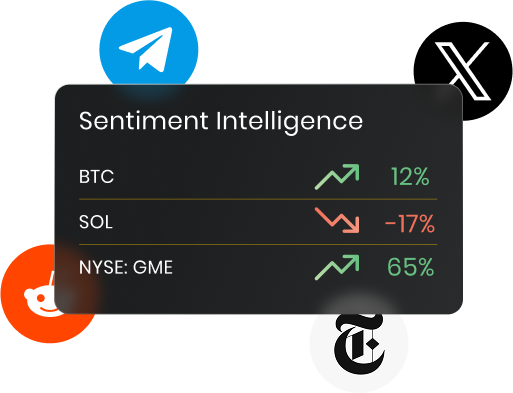

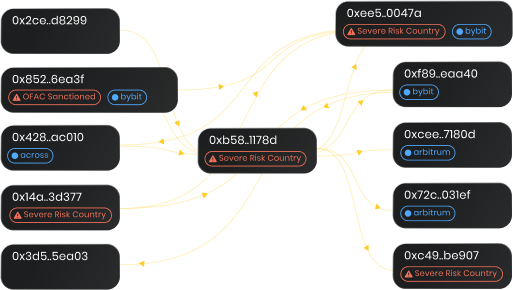

In today’s high-leverage, 24/7 crypto derivatives and perpetual futures (perps) markets, scammers aren’t just placing manipulative trades, they’re engineering liquidations to exploit exchange mechanics, drain funds, and vanish undetected by legacy surveillance and risk controls.

What’s Inside

- The Dual-Account Attack Playbook

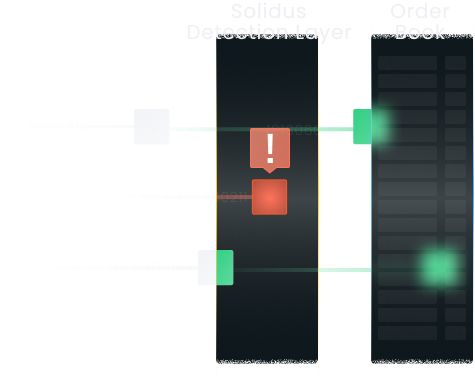

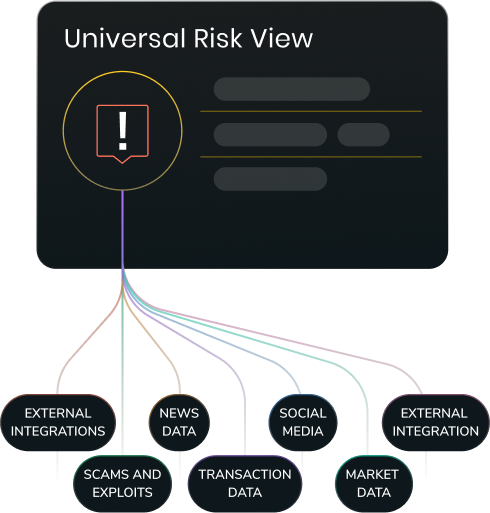

A detailed breakdown of how bad actors coordinate forced liquidations to trigger insurance fund payouts, while covering their tracks across wallets and accounts. - Why Derivatives Are So Exposed

Explore the structural flaws, like illiquidity, extreme leverage, and fragmented surveillance, that make crypto derivatives, perpetual futures (perps), and crypto futures markets prime targets for abuse. - TradFi vs. Crypto: A Risk Architecture Gap

What clearinghouses and layered margin frameworks solve in TradFi, and why crypto exchanges must take a different path. - How Solidus HALO Stops the Drain

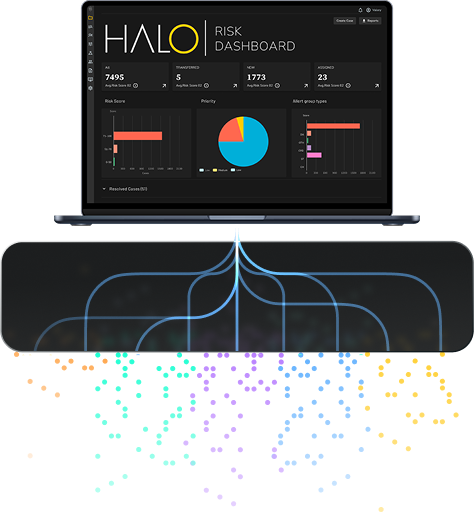

See how Solidus HALO’s AI-powered detection catches these schemes in real time, using behavioral signals, and transaction approval controls.

Who Should Read This

This report is essential reading for:

- Compliance professionals at crypto derivatives and perpetual futures exchanges

- Risk officers managing exchange insurance funds and futures reserves

- Surveillance analysts monitoring perps and leveraged futures markets

- Regulators overseeing market integrity in crypto futures

- Executives modernizing perpetuals market infrastructure

Read the Full Report

Learn how to defend your exchange before scammers strike. Discover how Solidus HALO equips your teams with the insights and workflows needed to catch and contain these threats, before they escalate.

This report examines manipulation risks specific to crypto perpetual futures (perps), leveraged derivatives, and digital asset futures markets, with a focus on liquidation abuse and insurance fund exploitation.